Corporate Banking

Customizable solutions to suit your needs.

Dedicated to private or public large companies with annual revenue in excess of $500 million, our Corporate Banking team works with large multi-national and regional banks to provide tailored solutions based on each client's individual capital needs. We work in tandem with agent banks, private business owners, private equity-owned companies, high net-worth family offices, and publicly traded companies to provide capital for acquisitions, growth, and general operating needs.

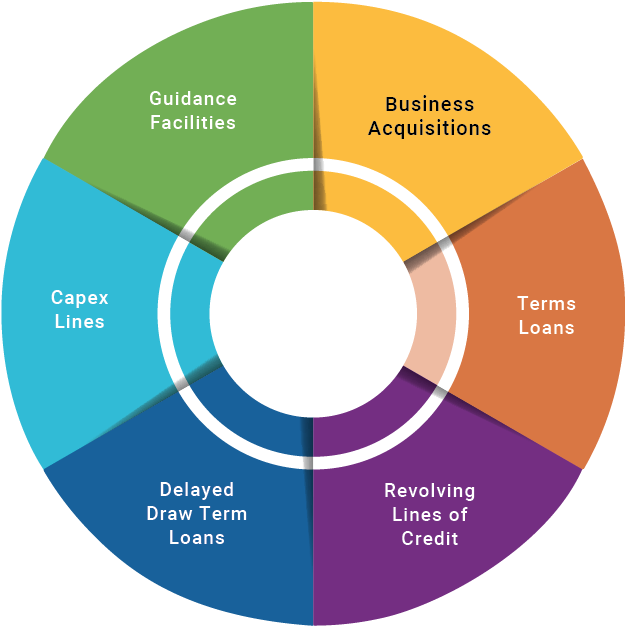

Financing Solutions(1)

We provide timely feedback, quick turnaround on deal approvals and funding, and deep knowledge of syndication markets and processes. We have experience handling and closing a wide range of opportunities from club deals of only a few banks to large, widely syndicated deals.

- Business Acquisitions

- Revolving Lines of Credit

- Term Loans

- Delayed Draw Term Loans

- Capex Lines

- Guidance Facilities

Industry Solutions

Our in-depth analysis of industry trends, years of sector experience, and our contact network, makes us a valuable resource for continued growth and ongoing financing needs in areas such as:

Manage RiskOur WNB Treasury Manager Positive Pay Service assists your company in protecting against check fraud. The service provides early warning of check irregularities, such as encoding errors and multiple postings. WNB Treasury Manager Positive Pay takes advantage of the latest Internet browser technology by making it easy to review transactions. Protecting your company’s accounts with WNB Treasury Manager Positive Pay has never been more important. Download WNB Treasury Manager Positive Pay Brochure PDF |

Participations and Syndications(1)National footprintThe Participations and Syndications team works with large multi-national and regional banks to provide tailored solutions based on each client. We work in tandem with Agent banks, private business owners, private equity-owned companies, high net-worth family offices, and publicly traded companies to provide capital for acquisitions, growth, and general operating needs. Our team has the capability to make meaningful capital contributions to bank groups with hold sizes up to $45MM. Woodforest Participations and Syndications team makes an excellent ally for Agent banks by providing timely feedback, quick turnaround on deal approvals and funding, and deep knowledge of the syndications market and process. |

Partnership Excellence

Our relationship managers are dedicated to partnership excellence. We are committed to providing exceptional service, and we care about your financial future as one of your trusted advisors.

Woodforest is a privately owned bank with the Employee Stock Ownership Plan being the largest single shareholder. In the spirit of “true ownership”, Woodforest employees strive to offer quality banking services and understand the financial needs of every client we serve. Woodforest employees have a vested interest in your company’s success.

Frequently Asked Questions

Owner of the Business

State Specific:

- Alabama – Business Occupational License issued by city or county where operating

- Florida – Registration of Fictitious Name filed with Department of State

- Georgia – Occupation Tax Certificate or Business License or Registration of Trade Name filed in county of operation

- Illinois – Assumed Name Application and Certificate of Ownership obtained from County Clerk’s office

- Indiana – Certificate of Assumed Name filed with County Recorder’s office in county where operating

- Kentucky – Certificate of Assumed Name filed with County Clerk’s office in county where operating

- Louisiana – Certificate of Assumed Name filed with Parrish Clerk’s office in county where operating

- Mississippi – Privilege Tax License filed in county or city where operating

- Maryland – Trade Name Registration filed with Maryland Department of Assessments and Taxation

- New York – Business Certificate filed with County Clerk’s office in county where operating

- North Carolina – Certificate of Assumed Name filed with Registrar of Deeds in county where operating

- Ohio – Trade Name Registration filed with Secretary of State

- Pennsylvania – Registration of Fictitious Name filed with Department of State

- South Carolina – Business License filed in county or city where operating or Retail License filed with state

- Texas – Certificate of Assumed Name filed with County Clerk’s office in county where operating

- Virginia – Certificate of Assumed Name or Fictitious Name filed with Circuit Court’s office in the county or city where operating

- West Virginia – Business Registration Certificate filed with West Virginia State Tax Department

Other:

- Franchise Agreement

- Only required if sole proprietorship is operating as a franchisee

- Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

- ID must be valid (non-expired)

- Social Security Numbers for each authorized signer

All general partners must be present and on the account.

-

Assumed Name Certificate / DBA

-

Required if partnership is doing business under a trade name

-

Also referred to as Fictitious Name Certificate or Name Registration

-

-

Partnership Agreement

-

Required if partnership is not clearly indicated on the Assumed Name Certificate / DBA

-

-

Franchise Agreement

-

Only required if partnership is operating as a franchisee

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each authorized signer

-

Taxpayer Identification Number (TIN/EIN) for the Partnership

-

Cannot be the Social Security Number of a partner

-

Apply anytime online at www.irs.gov or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

-

Documentation on each Beneficial Owner of the General Partnership

A Beneficial Owner is an individual who:

-

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation);

-

One individual with significant responsibility for controlling or managing the entity, for example the senior executive officer, senior manager, etc.

-

Federal regulation requires financial institutions, such as Woodforest, to obtain, verify and record information about the Beneficial Owner(s).

No. Any representative authorized to open an account on behalf of the legal entity can provide information about the Beneficial Owners via the Beneficial Ownership Form.

A completed Beneficial Ownership Form that includes information such as:

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

-

Certification that information provided is complete and correct

All general partners must be present and on the account. If the general partner is a legal entity, such as a corporation or LLC, the authorized representative (Director, Officer; Manager) of that entity may open the account. Legal entity general partners must be in good standing with the state.

-

Certificate of Partnership

-

Certificate of Filing

-

This certifies that the Certificate of Limited Partnership was filed with the state

-

-

Assumed Name Certificate / DBA

-

Only required if partnership is doing business under a trade name

-

Example: If “Smith Construction Ltd” also does business under “John’s Construction”, a DBA would be required

-

Also referred to as Fictitious Name Certificate or Name Registration

-

-

Franchise Agreement

-

Only required if partnership is operating as a franchisee

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each authorized signer

-

Taxpayer Identification Number (TIN/EIN) for the Partnership

-

Cannot be the Social Security Number of a partner

-

Apply anytime online at www.irs.gov or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

-

Documentation on each Beneficial Owner of the Limited Partnership

A Beneficial Owner is an individual who:

-

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation);

-

One individual with significant responsibility for controlling or managing the entity, for example the senior executive officer, senior manager, etc.

-

Federal regulation requires financial institutions, such as Woodforest, to obtain, verify and record information about the Beneficial Owner(s).

No. Any representative authorized to open an account on behalf of the legal entity can provide information about the Beneficial Owners via the Beneficial Ownership Form.

A completed Beneficial Ownership Form that includes information such as:

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

-

Certification that information provided is complete and correct

At least one individual appointed as Manager (or Managing Member) of the business within Articles/Certificate of Formation or most recent Public Information Report. If a state recognized Manager will not be signing on the account, a formal, notarized letter on company letter head authorizing the account to be established may be requested.

-

Articles of Organization (AKA Certificate of Formation or Certificate of Organization)

-

Certificate of Foreign Entity Registration and Foreign Articles of Organization (required if the LLC is opening an account in a state other than the state of original filing)

-

Assumed Name Certificate / DBA

-

Only required if corporation is doing business under a trade name

-

Example: If “Smith Construction LLC” also does business under “John’s Construction”, a DBA would be required

-

Also referred to as Fictitious Name Certificate or Name Registration

-

-

Franchise Agreement

-

Only required if corporation is operating as a franchisee

-

-

Proof that the LLC is active and/or in good standing in the applicable state

-

Typically referred to as a Certificate of Good Standing

-

In many cases, the Bank is able to obtain this information online. If the information cannot be obtained, you must provide the document. For example, businesses charted in Alabama must provide this documentation. Please contact your local branch for more information.

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each manager/member and any authorized signers

-

Taxpayer Identification Number (TIN/EIN) for the LLC

-

Cannot be the Social Security Number of a member (unless it is a single member LLC with no employees)

-

Apply anytime online at www.irs.gov or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

-

Documentation on each Beneficial Owner of the Limited Liability Company (LLC)

A Beneficial Owner is an individual who:

-

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation);

-

One individual with significant responsibility for controlling or managing the entity, for example the senior executive officer, senior manager, etc.

-

Federal regulation requires financial institutions, such as Woodforest, to obtain, verify and record information about the Beneficial Owner(s).

No. Any representative authorized to open an account on behalf of the legal entity can provide information about the Beneficial Owners via the Beneficial Ownership Form.

A completed Beneficial Ownership Form that includes information such as:

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

-

Certification that information provided is complete and correct

All general partners must be present and on the account. If the general partner is a legal entity, such as a corporation or LLP, the authorized representative (Director, Officer; Manager) of that entity may open the account. Legal entity general partners must be in good standing with the state.

-

Articles of Organization (AKA Certificate of Formation or Certificate of Organization)

-

Certificate of Filing (certifies Articles were filed with the state)

-

Certificate of Foreign Entity Registration of a Limited Partnership (required if the limited partnership is opening an account in a state other than the state of original filing)

-

Assumed Name Certificate / DBA

-

Only required if corporation is doing business under a trade name

-

Example: If “Smith Construction LLP” also does business under “John’s Construction”, a DBA would be required

-

Also referred to as Fictitious Name Certificate or Name Registration

-

-

Franchise Agreement

-

Only required if corporation is operating as a franchisee

-

-

Proof that the Partnership is active/and or in good standing in applicable state

-

Typically referred to as Certificate of Good Standing

-

In many cases, the Bank is able to obtain this information online. If the information cannot be obtained, you must provide the document. For example, businesses charted in Alabama must provide this documentation. Please contact your local branch for more information.

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each manager/member and any authorized signers

-

Taxpayer Identification Number (TIN/EIN) for the LLP

-

Cannot be the Social Security Number of a member (unless it is a single member LLP with no employees)

-

Apply anytime online at www.irs.gov or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

-

Documentation on each Beneficial Owner of the Limited Liability Partnership (LLP)

A Beneficial Owner is an individual who:

-

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation);

-

One individual with significant responsibility for controlling or managing the entity, for example the senior executive officer, senior manager, etc.

-

Federal regulation requires financial institutions, such as Woodforest, to obtain, verify and record information about the Beneficial Owner(s).

No. Any representative authorized to open an account on behalf of the legal entity can provide information about the Beneficial Owners via the Beneficial Ownership Form.

A completed Beneficial Ownership Form that includes information such as:

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

-

Certification that information provided is complete and correct

At least one individual appointed as Director or Officer of the business within Articles/Certificate of Formation or most recent Public Information Report. If a state recognized Director or Officer will not be signing on the account, a formal, notarized letter on company letter head authorizing the account to be established may be requested.

-

Certificate of Formation OR Articles of Incorporation

-

Certificate of Filing

-

Certificate of Foreign Entity Registration and Foreign Articles of Incorporation (required if the corporation is opening an account in a state other than the state of original filing)

-

Assumed Name Certificate/DBA

-

Only required if corporation is doing business under a trade name

-

Example: If “Smith Construction Inc.” also does business under “John’s Construction”, a DBA would be required

-

Also referred to as Fictitious Name Certificate or Name Registration

-

-

Franchise Agreement

-

Only required if corporation is operating as a franchisee

-

-

IRS Determination Letter

-

Only required if corporation is non-profit

-

-

Proof that the corporation is active and/or in good standing in the applicable state

-

Typically referred to as a Certificate of Good Standing

-

In many cases, the Bank is able to obtain this information online. If the information cannot be obtained, you must provide the document. For example, businesses incorporated in Alabama must provide this documentation. Please contact your local branch for more information.

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each authorized signer

-

Taxpayer Identification Number (TIN/EIN) for the Corporation

-

Cannot be the Social Security Number of an authorized signer/director/officer

-

Apply anytime online at www.irs.gov or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

-

Documentation on each Beneficial Owner of the Corporation

A Beneficial Owner is an individual who:

-

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation);

-

One individual with significant responsibility for controlling or managing the entity, for example the senior executive officer, senior manager, etc.

-

Federal regulation requires financial institutions, such as Woodforest, to obtain, verify and record information about the Beneficial Owner(s).

No. Any representative authorized to open an account on behalf of the legal entity can provide information about the Beneficial Owners via the Beneficial Ownership Form.

A completed Beneficial Ownership Form that includes information such as:

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

-

Certification that information provided is complete and correct

Officers or authorized party identified within the meeting minutes and notarized letter.

-

Organization’s Charter

-

Organization’s By-Laws or Operating Agreement

-

Signed Formal Letter, preferably on letterhead, and Signed Meeting Minutes stating the Organization’s intent to open an account and who will be authorized to sign

-

NOTE: This document is NOT sufficient on its own, rather it may be used in conjunction with the Organization’s Charter and By-Laws / Operating Agreement

-

-

Girl Scout Accounts

-

Documentation on Girl Scout Letterhead authorizing the customer as troop leader

-

-

Boy Scout Accounts

-

By-Laws and letter from Chartering Sponsor (i.e.: Church or School) appointing Den Leader; Meeting Minutes reflecting discussion to establish account and identifying authorized signers.

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each authorized signer

-

Taxpayer Identification Number (TIN/EIN) for the association

-

Cannot be the Social Security Number of an authorized signer

-

Apply anytime online at www.irs.gov/ or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

Additional Commercial Benefits

Treasury Management

Customized solutions to meet the unique needs of your business.

Merchant Services

Create operational efficiency to enhance your business growth.

Loans and Financing

Business financing options to help you look ahead, increase cash flow, buy, refinance, or expand.

(1) All loan products are subject to credit approval.

DIVULGACIONE

DIVULGACIONE

(1) All loan products are subject to credit approval.