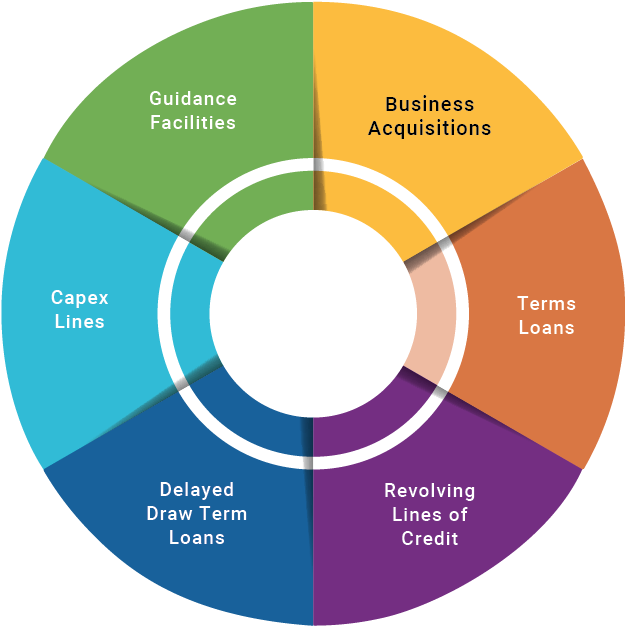

Business financing options to help you look ahead, increase cash flow, buy, refinance, or expand.

Term Loans(1)

Woodforest is here to help you grow your business. We offer a variety of term loans that are designed to meet your financing needs, from purchasing new equipment and company vehicles, to improving your existing facilities.

- Equipment financing

- Partnership buyouts

- Leasehold improvements

- Flexible terms based on loan purpose

Owner Occupied Real Estate(1)

We have financing options for all businesses looking to acquire their own commercial property, as well as improve or refinance existing locations.

- Expansion and remodeling

- Interest only periods during construction

- Fixed and floating rate options

- Cash-out refinancing on existing property

Lines of Credit(1)

We know the demands of operating a business. Controlling short term receivables or inventory, and making purchases to improve your business, can be challenging. Our Lines of Credit can give you immediate access to funds to help facilitate your working capital needs.(1)

- Funds conveniently accessible

- Interest only payments

- Flexible pricing

Investment Real Estate(1)

Whether you are purchasing, constructing, or improving an income producing property, Woodforest has an experienced team to help guide you through the financing process.

- Land purchases

- Acquisition financing

- Development financing

- Competitive refinancing

Industry Solutions

Specializing in businesses with annual revenue between $3 million and $20 million.

Focusing on companies with $20 million to $500 million in annual revenue.

Dedicated to private or public large companies with annual revenue in excess of $500 million.

Solutions tailored for the unique demands and challenges of the healthcare industry.

Offering financing and refinance opportunities for acquisition, development and improvement.

Participations and Syndications(1)National footprintThe Participations and Syndications team works with large multi-national and regional banks to provide tailored solutions based on each client. We work in tandem with Agent banks, private business owners, private equity-owned companies, high net-worth family offices, and publicly traded companies to provide capital for acquisitions, growth, and general operating needs. Our team has the capability to make meaningful capital contributions to bank groups with hold sizes up to $45MM. Woodforest Participations and Syndications team makes an excellent ally for Agent banks by providing timely feedback, quick turnaround on deal approvals and funding, and deep knowledge of the syndications market and process. |

Additional Commercial Benefits

Treasury Management

Customized solutions to meet the unique needs of your business.

Merchant Services

Create operational efficiency to enhance your business growth.

Wealth Management

The higher level of guidance your wealth deserves!

(1) All loan products are subject to credit approval.