Business Plus Checking*

Account Description

Enjoy unlimited check writing and earn interest all in one account. Business Plus Checking is only available to sole proprietorships, non-profit organizations, and government entities.

Key Benefit of This Account

- Unlimited check writing account that earns interest

Account Details

Minimum to open: $100.00

Monthly Service Charge:

- No Charge with Average Collected Balance(1) of $2,000.00 or above

- $15.00 with Average Collected Balance(1) of $0.00 to $1,999.99

Additional Account Service Charges:

- $0.15 per withdrawal(2)

- $0.10 per deposit item

- $0.50 per deposit posted to the account

Additional Account Features:

- Woodforest Business Debit Card(3)

Every qualifying customer can take advantage of the following benefits on this Woodforest Account

Frequently Asked Questions

Owner of the Business

State Specific:

- Alabama – Business Occupational License issued by city or county where operating

- Florida – Registration of Fictitious Name filed with Department of State

- Georgia – Occupation Tax Certificate or Business License or Registration of Trade Name filed in county of operation

- Illinois – Assumed Name Application and Certificate of Ownership obtained from County Clerk’s office

- Indiana – Certificate of Assumed Name filed with County Recorder’s office in county where operating

- Kentucky – Certificate of Assumed Name filed with County Clerk’s office in county where operating

- Louisiana – Certificate of Assumed Name filed with Parrish Clerk’s office in county where operating

- Mississippi – Privilege Tax License filed in county or city where operating

- Maryland – Trade Name Registration filed with Maryland Department of Assessments and Taxation

- New York – Business Certificate filed with County Clerk’s office in county where operating

- North Carolina – Certificate of Assumed Name filed with Registrar of Deeds in county where operating

- Ohio – Trade Name Registration filed with Secretary of State

- Pennsylvania – Registration of Fictitious Name filed with Department of State

- South Carolina – Business License filed in county or city where operating or Retail License filed with state

- Texas – Certificate of Assumed Name filed with County Clerk’s office in county where operating

- Virginia – Certificate of Assumed Name or Fictitious Name filed with Circuit Court’s office in the county or city where operating

- West Virginia – Business Registration Certificate filed with West Virginia State Tax Department

Other:

- Franchise Agreement

- Only required if sole proprietorship is operating as a franchisee

- Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

- ID must be valid (non-expired)

- Social Security Numbers for each authorized signer

All general partners must be present and on the account.

-

Assumed Name Certificate / DBA

-

Required if partnership is doing business under a trade name

-

Also referred to as Fictitious Name Certificate or Name Registration

-

-

Partnership Agreement

-

Required if partnership is not clearly indicated on the Assumed Name Certificate / DBA

-

-

Franchise Agreement

-

Only required if partnership is operating as a franchisee

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each authorized signer

-

Taxpayer Identification Number (TIN/EIN) for the Partnership

-

Cannot be the Social Security Number of a partner

-

Apply anytime online at www.irs.gov or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

-

Documentation on each Beneficial Owner of the General Partnership

A Beneficial Owner is an individual who:

-

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation);

-

One individual with significant responsibility for controlling or managing the entity, for example the senior executive officer, senior manager, etc.

-

Federal regulation requires financial institutions, such as Woodforest, to obtain, verify and record information about the Beneficial Owner(s).

No. Any representative authorized to open an account on behalf of the legal entity can provide information about the Beneficial Owners via the Beneficial Ownership Form.

A completed Beneficial Ownership Form that includes information such as:

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

-

Certification that information provided is complete and correct

All general partners must be present and on the account. If the general partner is a legal entity, such as a corporation or LLC, the authorized representative (Director, Officer; Manager) of that entity may open the account. Legal entity general partners must be in good standing with the state.

-

Certificate of Partnership

-

Certificate of Filing

-

This certifies that the Certificate of Limited Partnership was filed with the state

-

-

Assumed Name Certificate / DBA

-

Only required if partnership is doing business under a trade name

-

Example: If “Smith Construction Ltd” also does business under “John’s Construction”, a DBA would be required

-

Also referred to as Fictitious Name Certificate or Name Registration

-

-

Franchise Agreement

-

Only required if partnership is operating as a franchisee

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each authorized signer

-

Taxpayer Identification Number (TIN/EIN) for the Partnership

-

Cannot be the Social Security Number of a partner

-

Apply anytime online at www.irs.gov or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

-

Documentation on each Beneficial Owner of the Limited Partnership

A Beneficial Owner is an individual who:

-

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation);

-

One individual with significant responsibility for controlling or managing the entity, for example the senior executive officer, senior manager, etc.

-

Federal regulation requires financial institutions, such as Woodforest, to obtain, verify and record information about the Beneficial Owner(s).

No. Any representative authorized to open an account on behalf of the legal entity can provide information about the Beneficial Owners via the Beneficial Ownership Form.

A completed Beneficial Ownership Form that includes information such as:

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

-

Certification that information provided is complete and correct

At least one individual appointed as Manager (or Managing Member) of the business within Articles/Certificate of Formation or most recent Public Information Report. If a state recognized Manager will not be signing on the account, a formal, notarized letter on company letter head authorizing the account to be established may be requested.

-

Articles of Organization (AKA Certificate of Formation or Certificate of Organization)

-

Certificate of Foreign Entity Registration and Foreign Articles of Organization (required if the LLC is opening an account in a state other than the state of original filing)

-

Assumed Name Certificate / DBA

-

Only required if corporation is doing business under a trade name

-

Example: If “Smith Construction LLC” also does business under “John’s Construction”, a DBA would be required

-

Also referred to as Fictitious Name Certificate or Name Registration

-

-

Franchise Agreement

-

Only required if corporation is operating as a franchisee

-

-

Proof that the LLC is active and/or in good standing in the applicable state

-

Typically referred to as a Certificate of Good Standing

-

In many cases, the Bank is able to obtain this information online. If the information cannot be obtained, you must provide the document. For example, businesses charted in Alabama must provide this documentation. Please contact your local branch for more information.

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each manager/member and any authorized signers

-

Taxpayer Identification Number (TIN/EIN) for the LLC

-

Cannot be the Social Security Number of a member (unless it is a single member LLC with no employees)

-

Apply anytime online at www.irs.gov or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

-

Documentation on each Beneficial Owner of the Limited Liability Company (LLC)

A Beneficial Owner is an individual who:

-

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation);

-

One individual with significant responsibility for controlling or managing the entity, for example the senior executive officer, senior manager, etc.

-

Federal regulation requires financial institutions, such as Woodforest, to obtain, verify and record information about the Beneficial Owner(s).

No. Any representative authorized to open an account on behalf of the legal entity can provide information about the Beneficial Owners via the Beneficial Ownership Form.

A completed Beneficial Ownership Form that includes information such as:

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

-

Certification that information provided is complete and correct

All general partners must be present and on the account. If the general partner is a legal entity, such as a corporation or LLP, the authorized representative (Director, Officer; Manager) of that entity may open the account. Legal entity general partners must be in good standing with the state.

-

Articles of Organization (AKA Certificate of Formation or Certificate of Organization)

-

Certificate of Filing (certifies Articles were filed with the state)

-

Certificate of Foreign Entity Registration of a Limited Partnership (required if the limited partnership is opening an account in a state other than the state of original filing)

-

Assumed Name Certificate / DBA

-

Only required if corporation is doing business under a trade name

-

Example: If “Smith Construction LLP” also does business under “John’s Construction”, a DBA would be required

-

Also referred to as Fictitious Name Certificate or Name Registration

-

-

Franchise Agreement

-

Only required if corporation is operating as a franchisee

-

-

Proof that the Partnership is active/and or in good standing in applicable state

-

Typically referred to as Certificate of Good Standing

-

In many cases, the Bank is able to obtain this information online. If the information cannot be obtained, you must provide the document. For example, businesses charted in Alabama must provide this documentation. Please contact your local branch for more information.

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each manager/member and any authorized signers

-

Taxpayer Identification Number (TIN/EIN) for the LLP

-

Cannot be the Social Security Number of a member (unless it is a single member LLP with no employees)

-

Apply anytime online at www.irs.gov or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

-

Documentation on each Beneficial Owner of the Limited Liability Partnership (LLP)

A Beneficial Owner is an individual who:

-

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation);

-

One individual with significant responsibility for controlling or managing the entity, for example the senior executive officer, senior manager, etc.

-

Federal regulation requires financial institutions, such as Woodforest, to obtain, verify and record information about the Beneficial Owner(s).

No. Any representative authorized to open an account on behalf of the legal entity can provide information about the Beneficial Owners via the Beneficial Ownership Form.

A completed Beneficial Ownership Form that includes information such as:

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

-

Certification that information provided is complete and correct

At least one individual appointed as Director or Officer of the business within Articles/Certificate of Formation or most recent Public Information Report. If a state recognized Director or Officer will not be signing on the account, a formal, notarized letter on company letter head authorizing the account to be established may be requested.

-

Certificate of Formation OR Articles of Incorporation

-

Certificate of Filing

-

Certificate of Foreign Entity Registration and Foreign Articles of Incorporation (required if the corporation is opening an account in a state other than the state of original filing)

-

Assumed Name Certificate/DBA

-

Only required if corporation is doing business under a trade name

-

Example: If “Smith Construction Inc.” also does business under “John’s Construction”, a DBA would be required

-

Also referred to as Fictitious Name Certificate or Name Registration

-

-

Franchise Agreement

-

Only required if corporation is operating as a franchisee

-

-

IRS Determination Letter

-

Only required if corporation is non-profit

-

-

Proof that the corporation is active and/or in good standing in the applicable state

-

Typically referred to as a Certificate of Good Standing

-

In many cases, the Bank is able to obtain this information online. If the information cannot be obtained, you must provide the document. For example, businesses incorporated in Alabama must provide this documentation. Please contact your local branch for more information.

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each authorized signer

-

Taxpayer Identification Number (TIN/EIN) for the Corporation

-

Cannot be the Social Security Number of an authorized signer/director/officer

-

Apply anytime online at www.irs.gov or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

-

Documentation on each Beneficial Owner of the Corporation

A Beneficial Owner is an individual who:

-

Each individual, if any, who owns, directly or indirectly, 25 percent or more of the equity interests of the legal entity customer (e.g., each natural person that owns 25 percent or more of the shares of a corporation);

-

One individual with significant responsibility for controlling or managing the entity, for example the senior executive officer, senior manager, etc.

-

Federal regulation requires financial institutions, such as Woodforest, to obtain, verify and record information about the Beneficial Owner(s).

No. Any representative authorized to open an account on behalf of the legal entity can provide information about the Beneficial Owners via the Beneficial Ownership Form.

A completed Beneficial Ownership Form that includes information such as:

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

-

Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for Non-U.S. individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

-

Certification that information provided is complete and correct

Officers or authorized party identified within the meeting minutes and notarized letter.

-

Organization’s Charter

-

Organization’s By-Laws or Operating Agreement

-

Signed Formal Letter, preferably on letterhead, and Signed Meeting Minutes stating the Organization’s intent to open an account and who will be authorized to sign

-

NOTE: This document is NOT sufficient on its own, rather it may be used in conjunction with the Organization’s Charter and By-Laws / Operating Agreement

-

-

Girl Scout Accounts

-

Documentation on Girl Scout Letterhead authorizing the customer as troop leader

-

-

Boy Scout Accounts

-

By-Laws and letter from Chartering Sponsor (i.e.: Church or School) appointing Den Leader; Meeting Minutes reflecting discussion to establish account and identifying authorized signers.

-

-

Acceptable ID for each authorized signer (with the exception of U.S. Military ID's, photocopies of identifying documentation will be retained)

-

ID must be valid (non-expired)

-

-

Social Security Numbers for each authorized signer

-

Taxpayer Identification Number (TIN/EIN) for the association

-

Cannot be the Social Security Number of an authorized signer

-

Apply anytime online at www.irs.gov/ or call 1-800-829-4933 (7:00 AM – 10:00 PM, Monday - Friday)

-

Banking On The Go

Bank anytime, anywhere with our Woodforest Mobile Banking App(4).

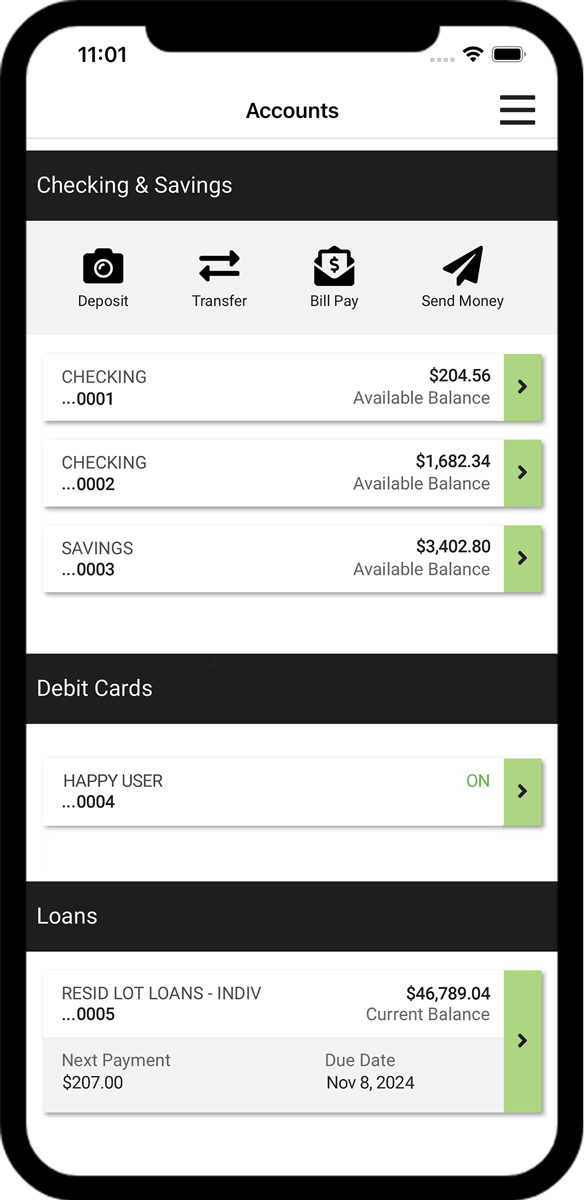

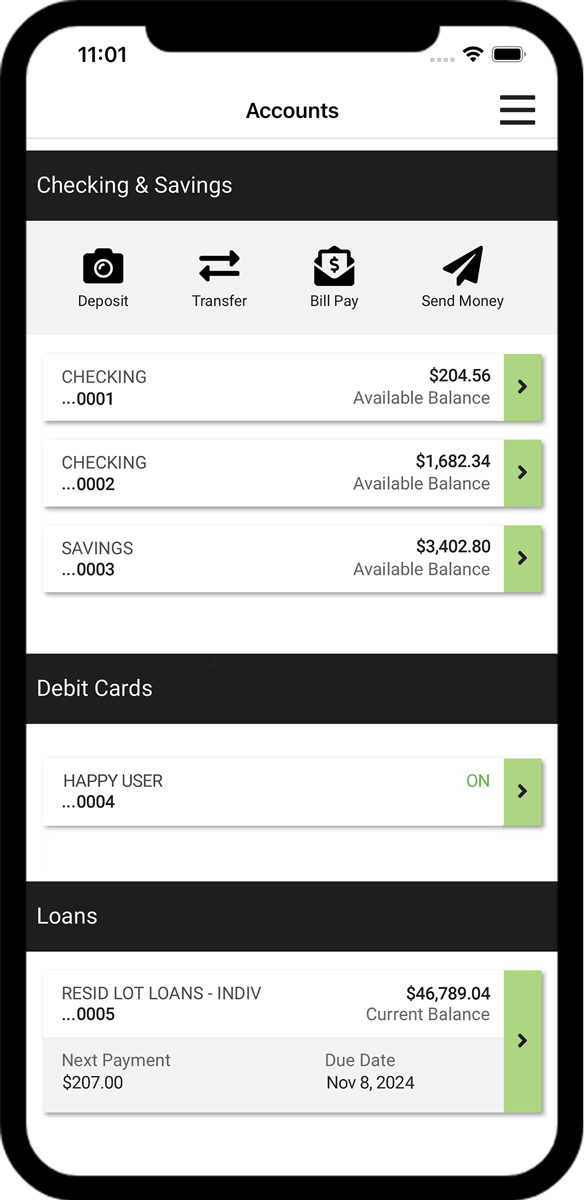

Manage Your Accounts

View balances, transactions, eStatements, set up account alerts, and more!

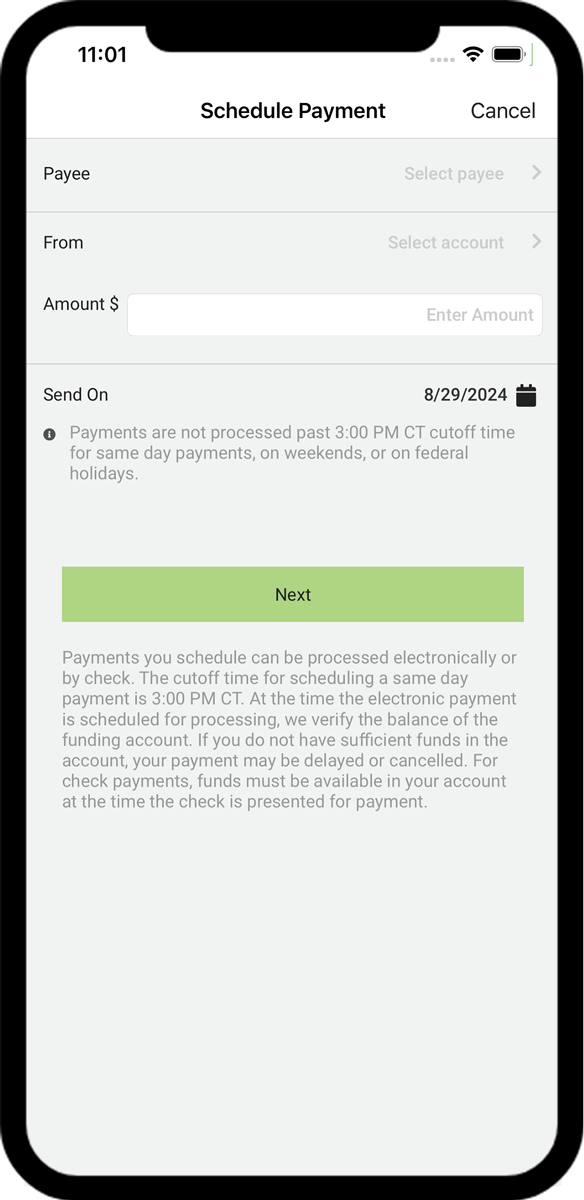

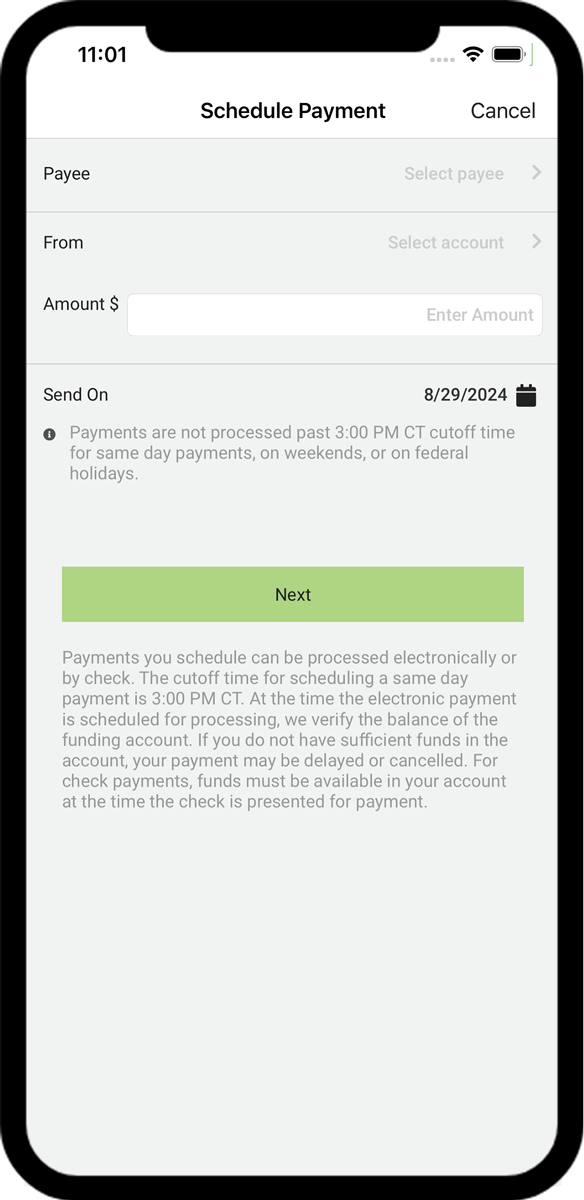

Pay Your Bills

Pay your bills, view payment history, and more.

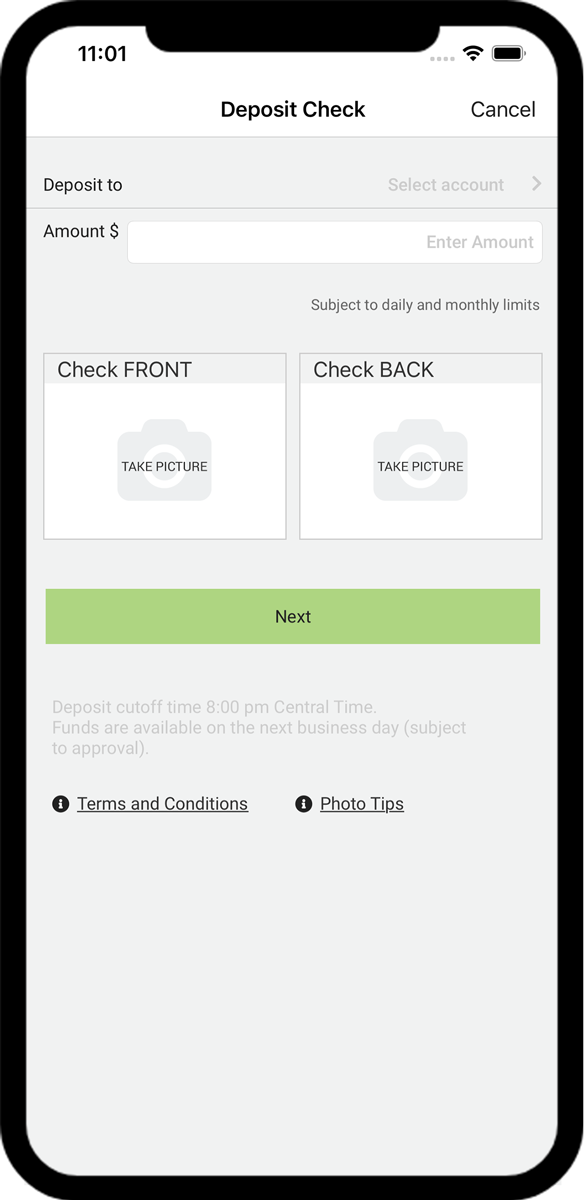

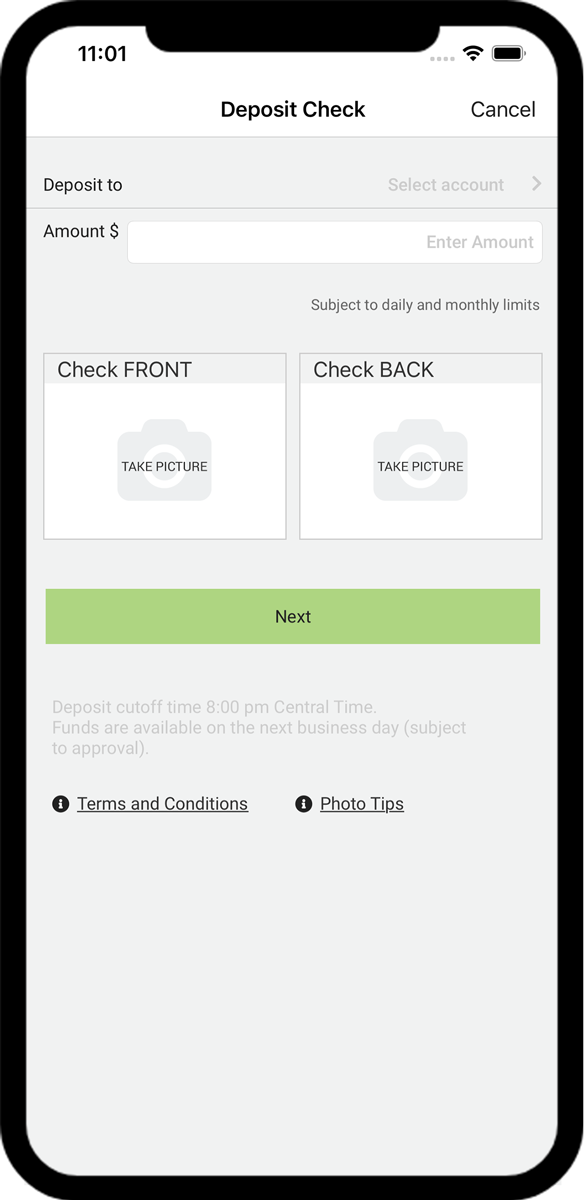

Mobile Deposit

Deposit checks at your convenience using your mobile phone! It's as easy as taking a photo!

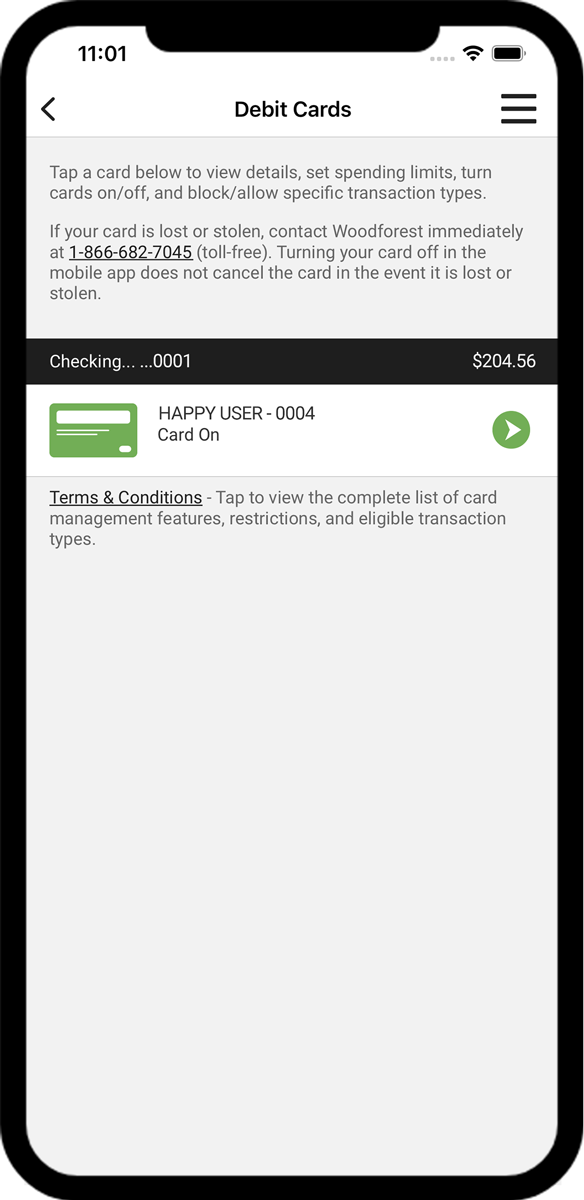

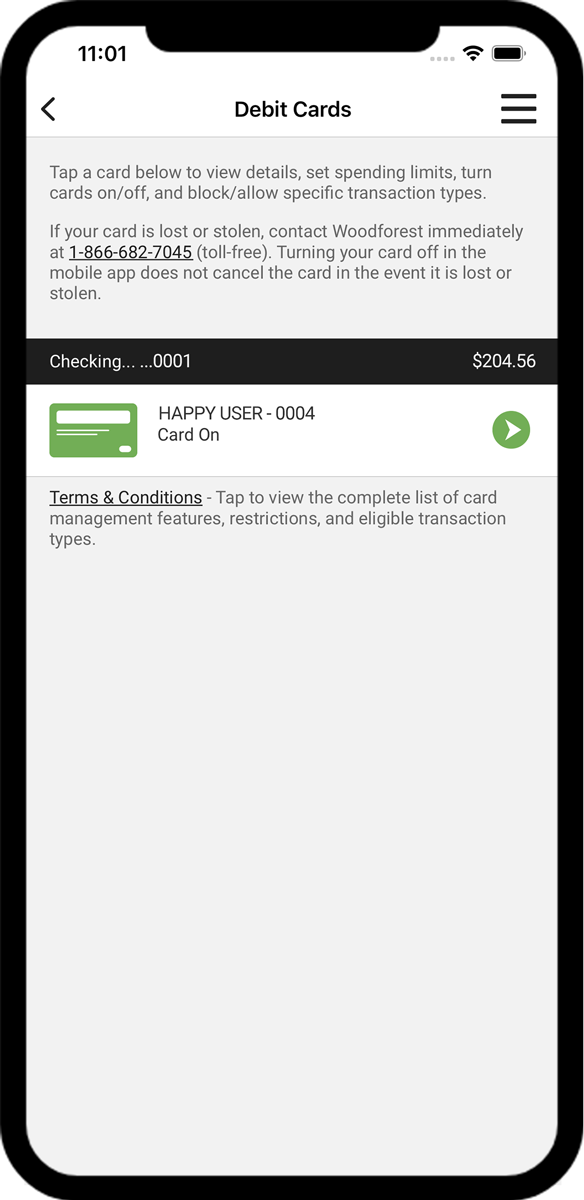

Debit Card Management

Control when, where, and how your Woodforest Debit Card is being used.Online and Mobile Banking(4) with Woodforest offers so much more!

Compare all of our Small Business Checking accounts to find your perfect fit!

Additional Small Business Benefits

Online & Mobile Banking

Access your account whenever and wherever with Online and Mobile Banking.(4)

Small Business Debit Cards

Use your debit card to manage your business, cash flow and company purchases.

Small Business Savings Accounts

Watch how quickly your money grows when you start saving.

*Regardless of account type, when items are presented for payment in excess of the balance in your account, an overdraft item fee will be assessed if the item is paid. This includes but is not limited to debit card transactions, such as ATM withdrawals, that are in excess of the balance in your account which may incur an overdraft item fee if the transaction is paid. The payment of overdraft items and transactions is at our discretion, and more than one overdraft item fee may be assessed in a single day. For complete details regarding our products, services, and fees, including important details regarding our overdraft fees and options, please stop by one of our convenient branch locations and speak with a Retail Banker.

(1) The average collected balance is the sum of the collected balance each day of the cycle divided by the number of days in the cycle.

(2) Withdrawals include any debit transaction.

(3) Each Woodforest Debit Card® ordered will be assessed a one time $15.00 set up fee that will be withdrawn out of the attached account. All other POS and ATM charges will still apply including surcharges that may be imposed by non-Woodforest ATM owners and operators.

(4) Data rates may apply. See carrier for details.

DISCLOSURE

DISCLOSURE

(1) The average collected balance is the sum of the collected balance each day of the cycle divided by the number of days in the cycle.

DISCLOSURE

DISCLOSURE

(2) Withdrawals include any debit transaction.

DISCLOSURE

DISCLOSURE

(3) Each Woodforest Debit Card® ordered will be assessed a one time $15.00 set up fee that will be withdrawn out of the attached account. All other POS and ATM charges will still apply including surcharges that may be imposed by non-Woodforest ATM owners and operators.

DISCLOSURE

DISCLOSURE

(4) Data rates may apply. See carrier for details.

DISCLOSURE

DISCLOSURE

*Regardless of account type, when items are presented for payment in excess of the balance in your account, an overdraft item fee will be assessed if the item is paid. This includes but is not limited to debit card transactions, such as ATM withdrawals, that are in excess of the balance in your account which may incur an overdraft item fee if the transaction is paid. The payment of overdraft items and transactions is at our discretion, and more than one overdraft item fee may be assessed in a single day. For complete details regarding our products, services, and fees, including important details regarding our overdraft fees and options, please stop by one of our convenient branch locations and speak with a Retail Banker.